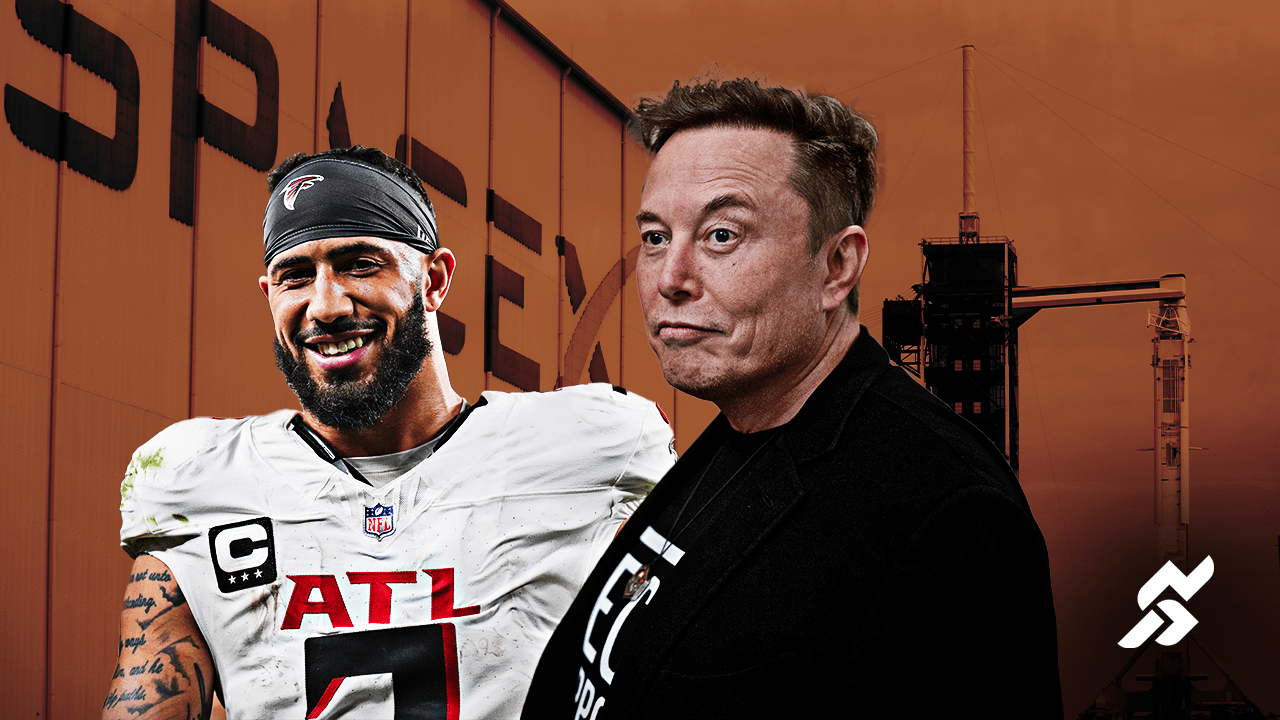

Atlanta Falcons safety Jessie Bates has investments in real estate and private equity ventures, among others. But none are as explosive as his investment in SpaceX, an aerospace company founded by tech billionaire Elon Musk.

Bates won’t call himself a supporter of Musk—he acknowledges the political weight of such a designation—but he respects the business prowess that helped the South African become one of the world’s richest people. Musk founded SpaceX in 2002; last month, the company launched the first human spaceflight orbiting both the Earth’s polar regions.

Bates’ investment got a boost Friday when the U.S. Space Force awarded SpaceX a $5.9 billion launch contract to send some of the Pentagon’s most sensitive satellites into space.

Yet Musk’s government relations have also brought notoriety—and put his businesses under scrutiny.

Musk, who is also the CEO of Tesla, has aligned himself with President Donald Trump in a manner that has seemed to benefit his own interests. He is leading controversial shutdowns and layoffs in federal government agencies—including ones responsible for overseeing his companies, such as the FAA—through his position atop the newly created Department of Government Efficiency. The group has slashed hundreds of thousands of jobs and hollowed out foreign aid programs.

Bates, 28, focuses on the upside of investing in arguably the world’s most active space launch company, seeing unrealized gains increase seven times since when he originally invested in 2019. The Pro Bowler understands the company’s polarizing reputation but views his stake as a learning opportunity as growth in the space economy accelerates.

“You can’t ignore how business-savvy these guys are and the leadership that they have in this space,” Bates said in a video interview. “It would be crazy if we didn’t think that [one day] people will be going to space normally. … You would be crazy not to educate yourself in that space and maybe participate in some investments. At the end of the day, it’s going to happen.”

Bates made his SpaceX investments with help from management consulting firm Rise Sports Advisors, which helps athletes invest into early-stage companies. Rise vice president of finance Jay Bass said he’s confident SpaceX will succeed because it has multiple revenues streams, including satellite internet constellation Starlink, which research firm Quilty Space projected to hit $11 billion in revenue this year. Bass views Musk’s close relationship with Trump as a positive, since the government advisor can influence U.S. policies that are beneficial to SpaceX.

“Honestly it helps more than it hurts,” Bass said. “Not that my ideologies on politics [necessarily] aligns, but from an economic standpoint, there will be massive benefits especially from a law perspective and getting government contracts.”

Rise received a SpaceX investment opportunity through a special purpose vehicle (SPV) in 2019 when the valuation hovered over $30 billion. It was not a typical move for Bates and the firm, since they usually invest in early-stage companies.

Bates decided to double down when he had the chance to invest more directly through a separate SPV, Summit Peak Ventures, three years later as part of its Series J round. Bates invested alongside former Cincinnati Bengals offensive lineman D’Ante Smith.

Bates invested six figures in 2019 and later invested another five figures, along with Smith, in the Series J round in 2022 that then valued the company at $127 billion. SpaceX most recently was valued at more than $350 billion, making it one of the world’s most valuable private companies.

“I didn’t know what to expect from it,” Smith said in a video interview. “I didn’t think it would fail but I didn’t know what to expect. With everything growing from Starlink, it opened my eyes to what the [investment] could do.”

Smith, who missed last NFL season with a patellar tendon injury, said he couldn’t foresee the eventual political ramifications for the SpaceX investment, because he put the money in the company early during the Joe Biden administration. At that time, Musk was not as overtly partisan as he is now.

Smith said he isn’t too concerned about the founder’s controversial partnership with Trump or how their relationship might influence the long-term value of his investment. Protesters have flocked to Tesla dealerships in recent weeks to voice their disapproval of Musk, but those types of actions have yet to extend to SpaceX.

“That remains to be seen,” said Smith, who also owns a slew of storage homes near Austin, Texas. “At the end of the day, I’m just going to let the business do the business.”

Bates and Smith are among other current and former athletes invested in SpaceX who won’t realize their gains until the Texas-based company goes public or sells. In the meantime, they’re paying attention to the media cycle surrounding Musk while the value of their original investment increases.

“As you watch the news and see articles, you just try to read up on it and ask as many questions as you can,” Bates said. “This is one of the pretty big investments that I’ve made and to see that it can be a 10x type of deal, that’s exciting.”