Fanatics has made its long-expected push into ticketing.

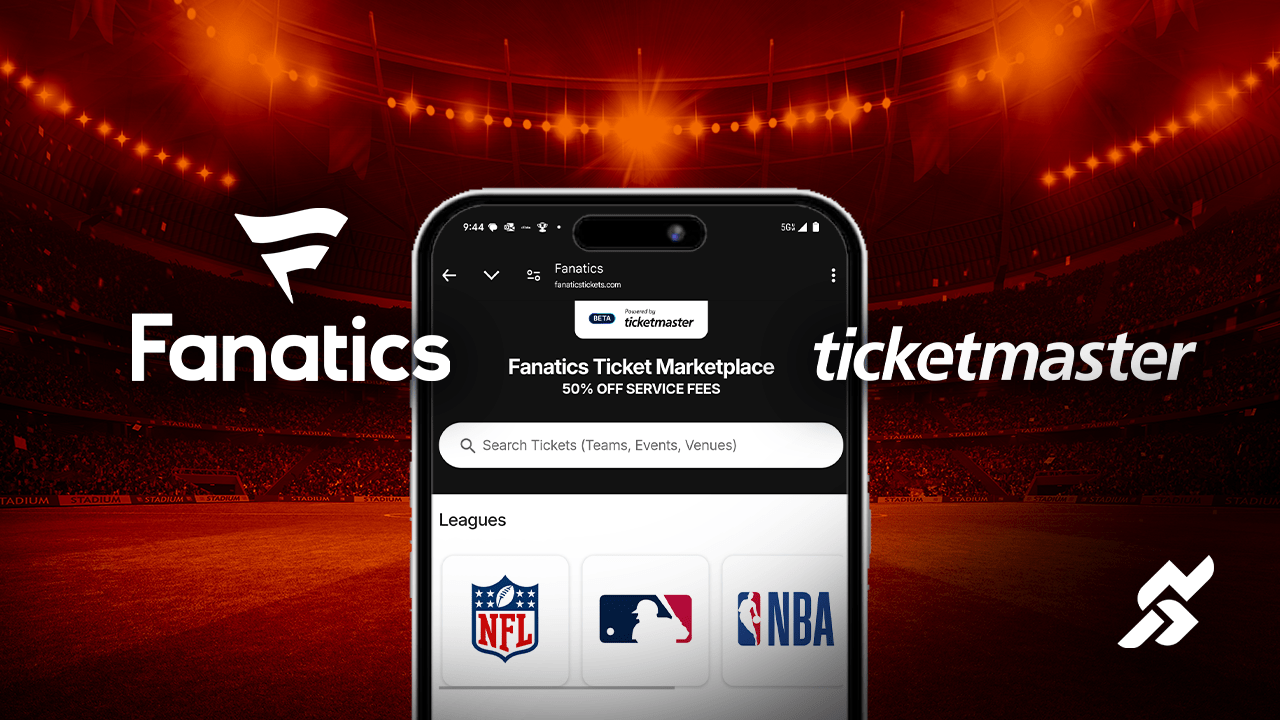

Michael Rubin’s company has partnered with Ticketmaster to create the Fanatics Ticket Marketplace, where users on the Fanatics app can now buy resale tickets alongside apparel, merchandise, trading cards and collectibles. The deal is part of a wider two-way partnership between Fanatics and the Live Nation unit, whereby Ticketmaster tickets list via Fanatics, and Fanatics merchandise lists via Ticketmaster.

This is the latest step in Rubin’s goal to make Fanatics a one-stop-shop for anything sports fans want to buy. Questions about ticketing have lingered around the company for years, growing louder as Fanatics expanded first into trading cards and then into sports betting. The group explored possible M&A, and it also looked into building its own platform before settling on the Ticketmaster partnership.

“When you look at the market position that Ticketmaster has built—we wanted to make sure we had as broad and comprehensive an offering as we could,” Fanatics chief strategy and growth officer Tucker Kain said in an interview. “Plus, having Ticketmaster/Live Nation as a potential partner across a number of things, like distributing our merchandise [through them], there’s an opportunity to start here and build a bigger partnership over time.”

While both sides declined to comment on the financial specifics, Kain clarified that it was a commercial partnership that does not involve equity.

The Fanatics Ticket Marketplace is only available on the Fanatics app, an indication of where the company sees its future. The app, redesigned last year, blends the company’s e-commerce, trading cards and free fantasy games—the sportsbook is still separate—utilizing personalization options and a loyalty currency, known as FanCash, to reward frequent users.

Fanatics is also starting to dabble in app-only exclusives. In addition to the ticket marketplace, which offers reduced fees to Fanatics buyers, the company is releasing product in MLB’s collaboration with Japanese artist Takashi Murakami that is strictly for mobile shoppers. Revenue from the app was up 80% in February 2025 vs. the same month in 2024, according to a Fanatics spokesperson.

The app is one of two main ways that Fanatics is trying to tie together all of its verticals. The other—its nascent events business—could theoretically also benefit from the link to Live Nation (NYSE: LYV). Kain declined to comment on whether this partnership would include collaborations on the event side.

For Ticketmaster, the partnership is also about broadening its assortment of offerings and reaching buyers in new places. It builds on a series of partnerships the company has with other partners, like Spotify, Meta and BandsInTown.com, where fans can buy tickets via Ticketmaster without starting on Ticketmaster's own app or website.

“Our job is to help all of our clients—sports, concerts, everybody—sell as many tickets as they can,” Joe Berchtold, president and CFO of Live Nation Entertainment, said in an interview. "Get the tickets in the hands of fans wherever they are, and there are a lot of sports fans at Fanatics."

Fanatics revenue was $8.1 billion in 2024, up 15% from 2023, Sportico reported earlier this year. The apparel and merchandise business is the biggest of its three main units ($6.2 billion in revenue), followed by trading cards ($1.6 billion) and gambling ($300 million).

The app sits in a fourth business unit, internally referred to as "platform services," that also includes the company’s events. Fanatics is looking to “harness the network effects” of its full scope of products in both the app and events, according to chief financial officer Glenn Schiffman.

“We want to make [the Fanatics app] a daily habit,” Schiffman said in an interview in January. “So you wake up every day, you check the scores from last night. This will also allow you to buy your favorite merch, play games and have an on-ramp into our betting experience and our collectibles experience.”

This isn’t the first time that Fanatics has partnered with another marketplace to cross-list its product. The company teamed with the NFL and Amazon in 2021 to sell licensed merchandise via the e-commerce behemoth. Not only does that widen the reach for Fanatics’ team and league partners, but it gives Fanatics more information on more sports fans around the world. Fanatics and Ticketmaster have also worked together in the past on a 2018 tie-up that was more narrowly focused on marketing.

Rubin speaks often about the company’s database of 100+ million sports fans. Offering more product in more places further boosts the value of that customer base.

“We didn’t think there was necessarily a need for just another ticketing company, so how does this actually add value?” Kain said. “We’re tying it to your Fanatics ID, so we can understand what a fan does across merchandise, trading cards, betting and now ticketing. And then it’s, how can we reward that?”